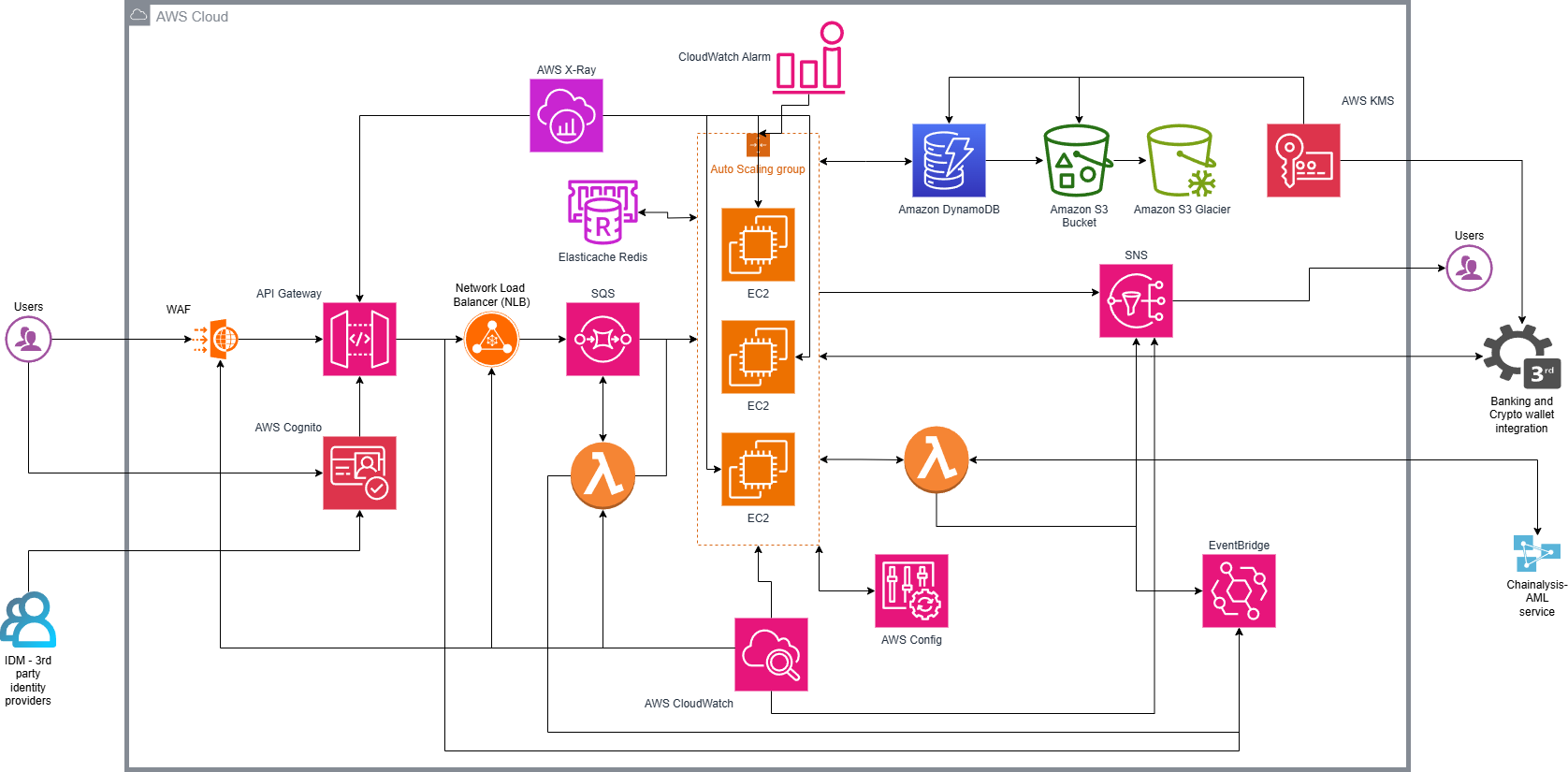

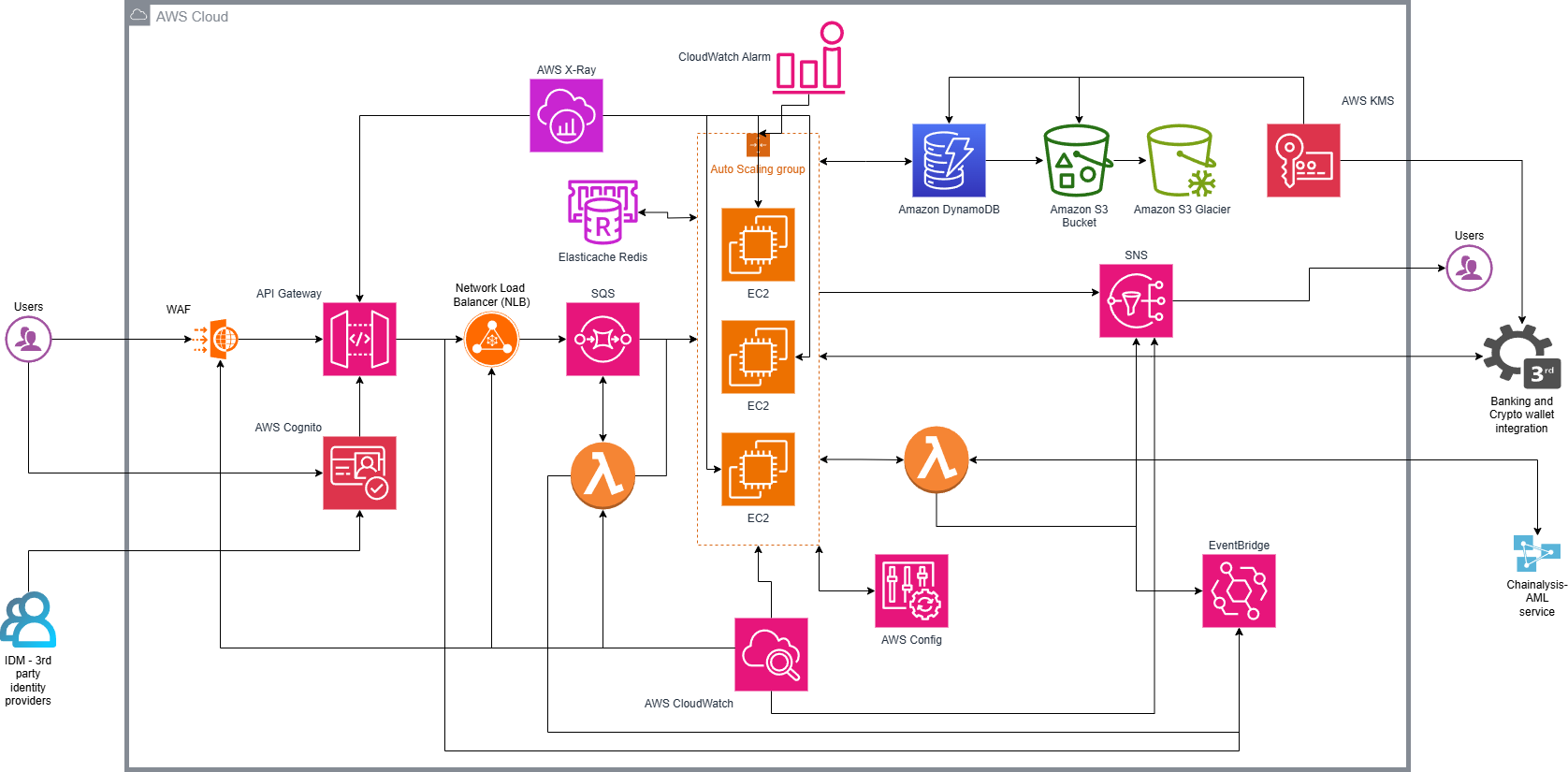

📌 AlphaPoint – Cryptocurrency Trading Platform Architecture

Designed and implemented an AWS-based architecture for a high-performance cryptocurrency trading platform at AlphaPoint, a B2B whitelabel crypto exchange provider. The system ensures scalability, security, and low-latency trading while integrating custom client requirements such as third-party banking, compliance, and encryption policies.

Enables ultra-low latency routing to EC2-based trading engines, essential for high-frequency transactions. Preferred over ALB for raw speed and protocol-level control, ensuring optimal performance under load.

A high-performance NoSQL database for capturing real-time trade activity and user session data. Offers seamless scaling and low-latency access, critical for trading reliability during volatile market conditions.

Reduces database overhead by caching live crypto price feeds and order book snapshots. Ensures millisecond-level data delivery for responsive client dashboards and trading algorithms.

Combines serverless compute with queue-based decoupling to process orders reliably, even under peak volume. Enhances fault tolerance while eliminating infrastructure overhead during PoC and scaling phases.

Manages secure user sign-in, KYC workflows, and federated identity integration for clients. Speeds up onboarding while enforcing authentication standards across different regulatory environments.

Ensures encryption of all sensitive trade and user data across APIs, storage, and databases. Key rotation and auditing support compliance for financial regulations like AML and GDPR.

Serves as the entry point for client apps, wallet integrations, and banking APIs. Provides throttling, versioning, and access control to maintain availability during trading spikes.

Stores trade logs, user data snapshots, and compliance artifacts. Lifecycle rules transition older data to Glacier for long-term archival, supporting audit readiness while reducing storage costs.

Enables visibility into order execution flows and system latency. Used for real-time monitoring, anomaly detection, and ensuring consistent performance across critical workloads.

Delivers real-time trade confirmations and platform alerts to end users and client systems. Supports both customer-facing messaging and internal automation triggers.

WAF protects APIs from malicious traffic, rate limits abuse, and stops common attack vectors (e.g., SQL injection, cross-site scripting). Positioned before API Gateway, it acts as a front-line filter, offloading security logic from app code.

EventBridge connects app activity with downstream triggers like compliance checks, fraud alerts, or analytics updates — reducing manual intervention. It enables rule-based automation that adapts to system events in real time.

This scalable, secure, and high-speed trading architecture supports customizable B2B crypto exchanges, adapting to various client needs while maintaining regulatory compliance and real-time performance.

This architecture balances performance, security, and scalability, ensuring institutions can launch robust crypto exchanges with minimal operational overhead. 🚀🔥